Economic indicators are vital signs of a country’s financial health and future trajectory. Despite optimistic statements from political leaders about economic stability, these indicators tell a more nuanced story, reflecting both challenges and opportunities in the financial landscape of the USA.

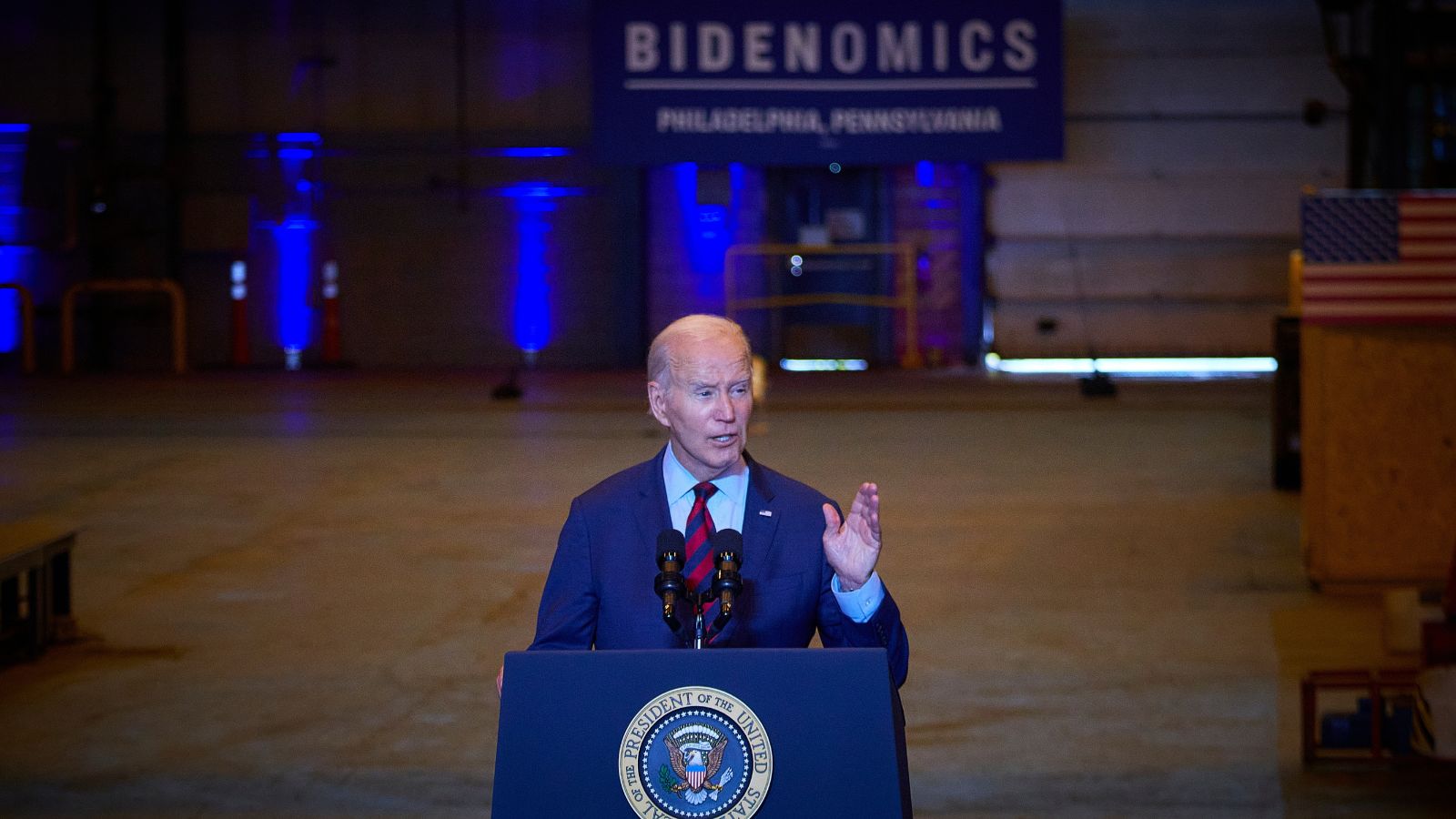

Strengthening Infrastructure

Editorial credit: Consolidated News Photos / Shutterstock.

The Biden administration has prioritized strengthening American infrastructure and industries, aiming to boost the nation’s economic foundation and global competitiveness. This has involved substantial allocations towards improving both transportation and digital infrastructure. Investing in these critical areas, the government aims to modernize and revitalize key sectors, laying a solid groundwork for future growth and prosperity. The administration’s focus underscores the importance of infrastructure in driving economic development and maintaining America’s position in the global market.

The American Infrastructure

Editorial credit: niculniea / Shutterstock.

According to the Council on Foreign Relations, the Biden administration spearheads the most significant federal infrastructure investment in decades to address the pressing need for modernization. Recognizing the perilously strained state of US infrastructure, especially compared to global competitors like China, Congress passed a historic bill in November 2021. This legislation allocates hundreds of billions of dollars to upgrade vital systems. Despite ongoing debate over funding methods, the Infrastructure Investment and Jobs Act dedicates $550 billion to revitalize roads, bridges, railways, airports, and water systems.

Local Production

Editorial credit: William Potter / Shutterstock.

Focusing on strengthening local manufacturing and bolstering the clean energy sector is a cornerstone of the administration’s agenda, aiming to generate employment opportunities, curb unemployment rates, and fortify economic resilience and stability.

Empowering the Workforce

Editorial credit: max dallocco/Shutterstock.

The ongoing pursuit of record-low unemployment rates across diverse demographics reflects a robust resurgence in the labor market, underscoring the success of investments in education that aim to equip individuals with the necessary skills to navigate the economic landscapes and thrive amidst modern financial challenges.

Encouraging Market Competition

Editorial credit: OogImages / Shutterstock.

A central theme of Bidenomics involves prioritizing the promotion of competition across various sectors, with the overarching goal of counteracting the trend of the increase in industry consolidation and cultivating a vibrant, inclusive economic marketplace that benefits consumers and businesses across the US.

Economic Growth

Editorial credit: ShutterstockProfessional/ Shutterstock.

The US economy has displayed resilience and growth, surpassing expectations with real GDP rising due to increased job opportunities, higher incomes, and boosted consumer spending. USA Facts reported a 2.1% GDP growth in 2022, following a 5.9% increase in 2021. Despite a first-half dip, GDP reached $25.5 trillion by year-end. Inflation, while down from a peak of 9.1% in June 2022, remained a concern at 6.5% in December, driven by rising food, energy, and housing costs throughout the year.

Economic Performance Review

Editorial credit: Tomasz Makowski / Shutterstock.

Analyzing economic performance under President Biden’s tenure compared to past administrations sheds light on its direct influence on employment rates, income levels, export metrics, and the country’s overall economic well-being. This comparison offers valuable insights into the trajectory and effectiveness of current policies and strategies to foster sustainable growth and prosperity.

Economic Warning Signs

Editorial credit: Summit Art Creations / Shutterstock.

Ongoing talks continue as the yield curve inverts, a sign of recession, raises concerns about future economic downturns. This prolonged inversion amplifies concerns among experts and policymakers, sparking debates about the resilience of the economy and the effectiveness of intervention strategies. Observers study economic indicators closely, seeking clues about the trajectory of future developments and the potential impact on various sectors and demographics.

Mounting Household Debt Burden

Editorial credit: William Potter / Shutterstock.

The surge in household debt across diverse sectors underscores the financial strains and vulnerabilities confronting American households. Data from Experian reveals that the total consumer debt in the United States surged to $17.1 trillion in 2023, marking a 4.4% uptick from $16.38 trillion in 2022. However, this growth rate in 2023 represents a slowdown compared to the 7% increase from 2021 to 2022.

Rising Delinquency Concerns

Editorial credit: fizkes / Shutterstock.

The rise in late payments on credit cards and loans, especially among younger borrowers, signals growing financial struggles. This trend sparks worries about its lasting impact on the economy. Experts and policymakers are closely watching as these late payment rates keep going up to grasp how it affects people and the economy overall.

Addressing the Savings Conundrum

Editorial credit: mojo cp / Shutterstock.

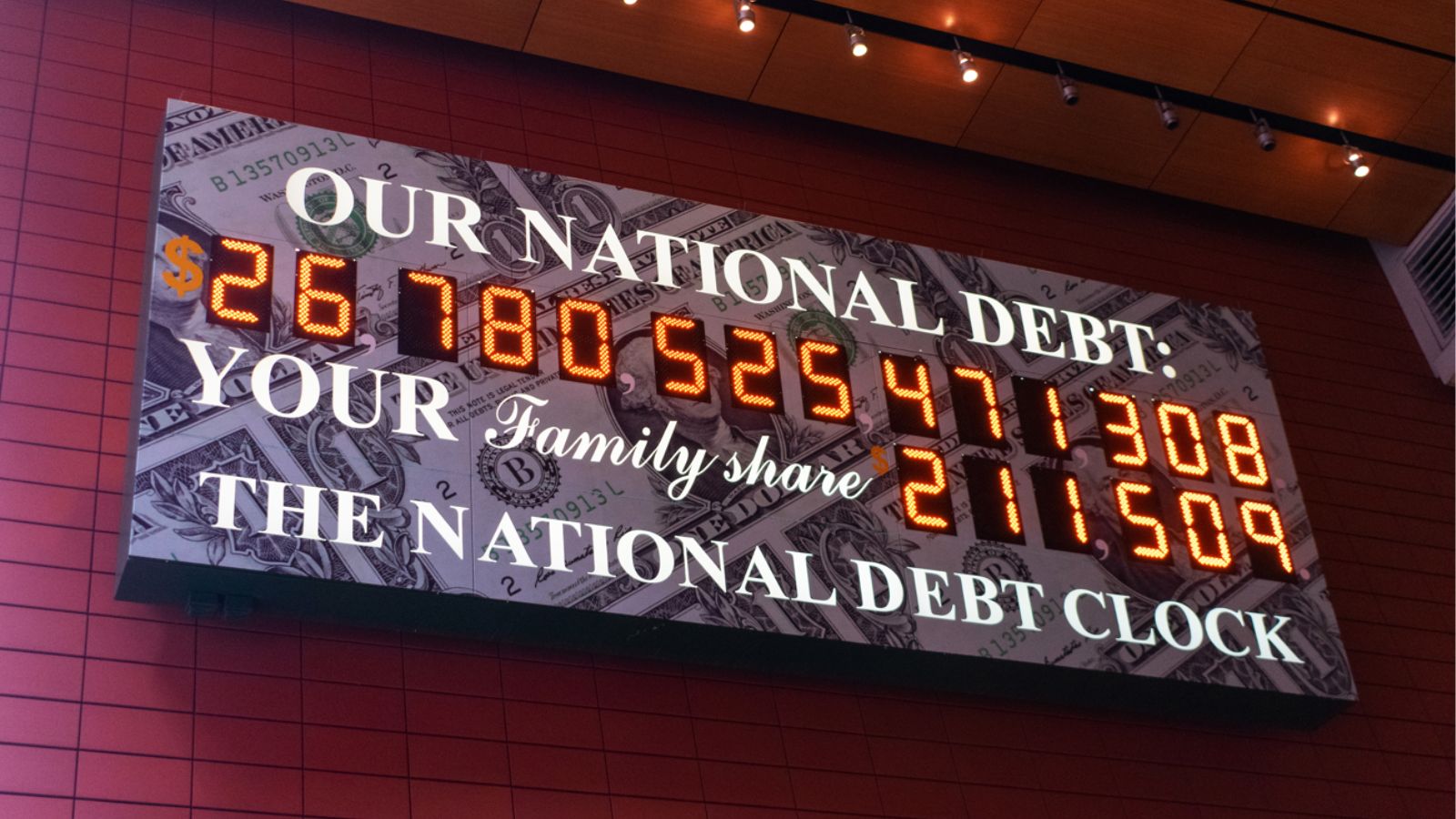

Growing Alarm Over Federal Debt

Editorial Credit: Good dreams – Studio / Shutterstock.

With federal debt soaring, there’s uncertainty about how sustainable current fiscal strategies are. This emphasizes the need for careful budget oversight and management. The growing debt worries policymakers and economists, who urge decisive action to tackle future fiscal challenges. As the debate heats up, it’s clear responsible fiscal management is vital for the nation’s long-term financial well-being.

Navigating Debt Interest Pressures

Editorial credit: Andrey_Popov / Shutterstock.

As the costs of paying off the national debt go up, they compete more with other important federal spending goals, showing the urgent need for sustainable debt management methods.

Tackling Debt Interest Dilemmas

Editorial credit: Michael Vi / Shutterstock.

Rising costs of paying off the national debt pose a challenge as they compete with other important federal spending priorities. This highlights the necessity for implementing effective and sustainable debt management strategies. As interest expenses increase, policymakers must make difficult choices about where to allocate resources, balancing the need to address debt obligations with other crucial demands in sectors vital for the nation’s well-being and progress.

Addressing Funding Constraints

Editorial credit: EtiAmmos / Shutterstock.

Rising interest costs limit the government’s ability to fund essential services, adding pressure on future budgets and investments. As interest expenses keep increasing, policymakers must balance fulfilling crucial obligations with sustainable fiscal management. This requires smart decision-making and creative solutions to maximize limited resources amid growing financial constraints.

Navigating Financial Discussions

Editorial credit: d.ee_angelo/ Shutterstock.

The debate surrounding financing options, whether through tax hikes or expanded money creation, presents policymakers with intricate decisions amid current inflationary patterns, necessitating thorough examination.

Tax Policy and Economic Expansion

Editorial credit: Constantin Stanciu/ Shutterstock.

Implementing tax increases carries potential hazards for economic growth. It may disproportionately affect various income brackets, whereas augmenting currency circulation could worsen inflationary pressures.

Ensuring Social Program Longevity

Editorial credit: LisaCarter / Shutterstock.

As the US relies on foreign investment for its debt, concerns arise about the future of important social welfare programs amidst changing global investment trends. As investment patterns change, policymakers must ensure these vital safety nets for citizens remain intact. Balancing fiscal responsibility with support for vulnerable populations demands careful planning and strategic decision-making.

Managing Fiscal Priorities and Social Support

Editorial credit: Studio Romantic/Shutterstock.

As interest rates climb, policymakers confront challenging decisions regarding allocating resources for crucial social safety nets. This underscores the essential role of critical fiscal management in ensuring the sustainability of programs that assist vulnerable populations. Maintaining a delicate balance between budgetary responsibilities and societal needs becomes increasingly imperative in navigating uncertain economic landscapes.

Assessing the Economic Landscape

Editorial credit: Minerva Studio / Shutterstock.

Despite positive signs such as rising wages and lower inflation, doubts about the effectiveness of Biden’s economic policies persist due to current economic conditions and concerns about living costs. However, efforts aimed at economic recovery and reducing inequalities offer some hope amidst ongoing uncertainties.

20 Reasons to Reconsider Supporting Donald Trump

Editorial credit: Cavan-Images / Shutterstock.

20 Reasons to Reconsider Supporting Donald Trump

Trump Descends Into Social Media Meltdown After Lincoln Project Faults Him in Ad

Editorial credit: lev radin / Shutterstock.

Trump Descends Into Social Media Meltdown After Lincoln Project Faults Him in Ad

21 Things Ruined by MAGA Followers, Affecting Us All

Image Credit: Shutterstock.

21 Things Ruined by MAGA Followers, Affecting Us All

21 Phrases That Out You as a Republican Voter

Editorial credit: a katz / Shutterstock.

21 Phrases That Out You as a Republican Voter

The 21 Most Dislikeable Politicians in the United States

Editorial credit: lev radin / Shutterstock.

The 21 Most Dislikeable Politicians in the United States