As we look towards January 20, 2025, the occupant of the highest office in the White House will wield significant influence over financial regulations that could impact the retired demographic of the United States. With uncertainty shrouding the future leader and the potential implications, it becomes imperative for retirees and those nearing retirement to assess the various scenarios that may unfold carefully. Exploring ten potential ramifications, we delve into how a possible continuation of President Trump’s tenure could shape financial landscapes for this demographic.

Trade Policy

Editorial credit: Mike Mareen / Shutterstock.

Trump’s presidency left a mark on trade policy, impacting finances directly. His administration strongly opposed international trade, aiming for fairer deals and safeguarding American industries. Tariffs imposed on imports, particularly from China, sparked trade tensions and retaliatory measures. While intended to bolster domestic jobs and industries, it also increased consumer prices and disrupted supply chains. A potential second term could see further changes in how the US engages in global trade, potentially influencing stock prices and savings. Yet, outcomes will hinge on evolving laws and international dynamics. Carnegie’s recent U.S.-China trade study suggests Trump’s policies cost the economy a quarter-million jobs, but it underscores the need for updated trade policies aligned with modern realities.

Job Market Performance

Editorial credit: zimmytws/ Shutterstock.

Assessing the influence of Trump’s economic strategies on the labor market sparked extensive discussion. Pre-pandemic unemployment hit historic lows, partly credited to deregulation and job initiatives. Nonetheless, skeptics contended that job expansion merely extended an existing trend rather than stemming directly from Trump’s policies. The pandemic-induced economic slump triggered a surge in unemployment, casting doubt on the sustainability of progress during Trump’s tenure.

Tax Policy

Editorial credit: Constantin Stanciu/ Shutterstock.

During Trump’s first term, significant changes to tax law occurred, with the potential for similar actions in the future. The Tax Cuts and Jobs Act of 2017, a hallmark of his tenure, aimed to bolster economic growth by reducing corporate tax rates and offering relief for individuals. Despite benefiting many, criticisms arose over the disproportionate benefits favoring the wealthy and corporations, leaving the middle class with modest reductions. The Pew Research Center reports that partisan divides are evident in perceptions of the tax system’s fairness. While overall views on the tax law remain relatively stable, fewer Republicans strongly approve compared to earlier years.

Changes to Social Security

Editorial credit: J.J. Gouin / Shutterstock.

Trump could enact adjustments to government programs aiding retirees. Although talks of modifying Social Security arose, no significant alterations transpired during his tenure. Potential proposals to amend these programs could profoundly impact retirees’ financial stability. This emphasizes the need for retirees to stay abreast of developments and remain ready to adapt financial and estate planning approaches accordingly.

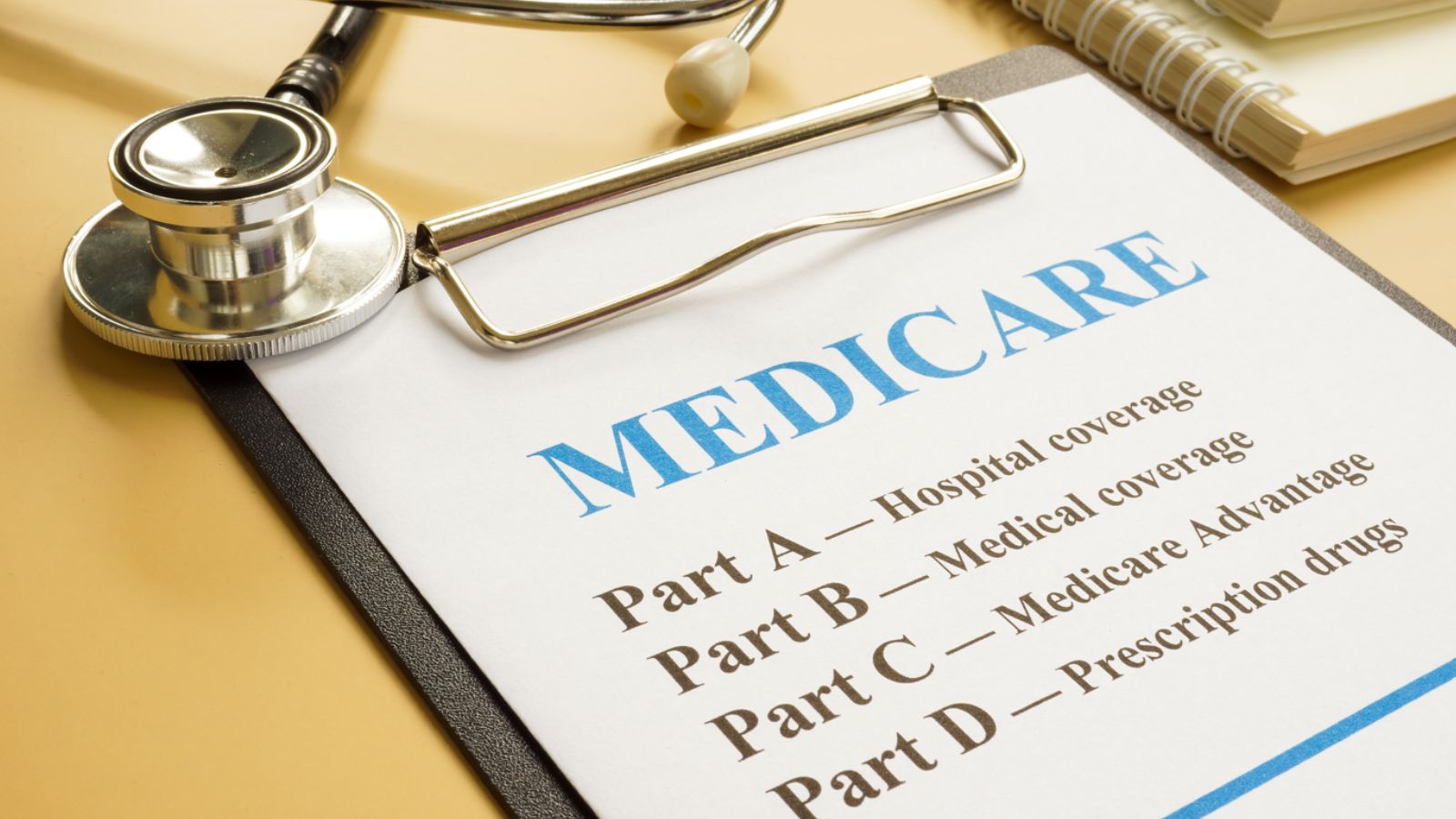

Medicare During the Trump Administration

Editorial credit: Vitalii Vodolazskyi / Shutterstock.

Medicare, the federal health insurance program catering to Americans aged 65 and above, underwent shifts during Trump’s presidency. Among these adjustments was the broadening of telehealth services. In response to the COVID-19 pandemic, the administration facilitated more accessible access to virtual healthcare appointments for Medicare beneficiaries. This alteration enhanced convenience and accessibility to healthcare, especially for individuals in remote or underserved regions. However, the Trump administration proposed significant modifications to Medicare funding alongside these enhancements. One such proposal involved reducing Medicare expenditures by introducing a unified payment system for specific services referred to as the International Pricing Index (IPI) model. Additionally, the administration suggested broadening the range of services covered by Medicare Advantage plans, granting greater flexibility in delivering supplementary benefits beyond those offered under the traditional Medicare program.

Stock Market Performance

Editorial credit: Bigc Studio / Shutterstock.

Throughout Trump’s tenure, the stock market underwent notable ups and downs. Initially, optimism spurred by promised tax cuts and deregulation propelled the market to historic highs. Yet, trade uncertainties and geopolitical tensions introduced volatility. The COVID-19 pandemic exacerbated these fluctuations, triggering a crash and a robust recovery. While stock market performance affects investment portfolios, its direct impact on everyday finances varies, especially for those with limited stock investments. Reuters highlights the market’s resilience, noting a significant rise, with the S&P 500 soaring over 50% since the November 2016 election, surpassing gains seen in the four years following Obama’s initial election win in 2008.

Housing Finance Overhaul

Editorial credit: trekandshoot / Shutterstock.

The Trump administration may forge ahead with its bold reformation of the housing finance sector. The Federal Housing Finance Agency (FHFA) has embarked on the challenging endeavor of transitioning Fannie Mae and Freddie Mac, the entities underpinning most of the nation’s mortgages, back into private hands. Measures have been taken to empower these entities to enhance their financial footing by retaining more earnings. Moreover, new capital requisites are in the works and are slated for completion by year-end. In a potential second term, FHFA Director Mark Calabria could proceed with initiatives to secure billions in additional capital from private sources. This strategy aims to streamline their operations, fortify internal controls, and mitigate risk exposure.

Student Loans

Editorial credit: ITTIGallery / Shutterstock.

The Public Service Loan Forgiveness (PSLF) program was initially devised to alleviate federal student loan burdens for individuals engaged in public service roles for a decade while meeting specific payment criteria. However, during Trump’s administration, the program underwent scrutiny and modifications, complicating the path to loan forgiveness. Eligibility requirements were tightened, resulting in disqualification or prolonged waits for many borrowers. Additionally, certain safeguards for student loan borrowers were rescinded. In 2017, regulations established during the Obama era, aimed at shielding borrowers from exploitative tactics by loan servicers, were rolled back. This left numerous borrowers with limited recourse against mistreatment or unjust practices.

Bank Capital

Editorial credit: Paul Brady Photography/Shutterstock.

Trump’s administration has relaxed capital and liquidity rules for domestic lenders through 2018 deregulation legislation. While this benefited many, central U.S. banks with global presence saw limited impact. Wall Street banks may secure further capital relief if re-elected, particularly regarding the “G-SIB surcharge,” opposed by globally systemically important banks. The “Collins Amendment,” imposing minimum leverage and capital requirements post-financial crisis, could also see scrutiny. Federal Reserve officials, open to temporary easing with Congressional approval, may face pressure for permanent relief. Another Trump term would extend the banking sector’s push for regulatory relaxation.

Fintech Push

Editorial credit: Wright Studio / Shutterstock.

The Trump administration has emerged as a prominent supporter of fostering innovation within financial services, actively facilitating easier access for technology firms to enter the banking realm. A potential second term would grant Trump officials greater latitude to delve deeper into this often contentious domain. Brian Brooks, the interim head of the Office of the Comptroller of the Currency (OCC), ardently champions the idea that fintech firms should be permitted to seek federal banking charters, enabling them to expand nationwide more freely. Although this proposal has faced legal challenges from state regulators, a second Trump tenure would give the OCC more opportunity to advance its agenda. Under Trump’s leadership, the Federal Deposit Insurance Corporation has resumed issuing special depository licenses to non-bank entities for the first time in over ten years, opening pathways for more non-bank entities to enter the sector if Trump secures victory in the upcoming election.

Capital Markets Reform

Editorial credit: stoatphoto / Shutterstock.

Since 2018, when efforts to revamp US capital markets rules faced setbacks, Republican lawmakers and lobbyists have urged the Securities and Exchange Commission (SEC) to utilize its authority to reduce regulatory burdens for listed firms and facilitate the IPO process for private companies. Experts predict that under a second Trump term, the SEC would persist in revising corporate disclosure and reporting regulations while easing constraints on private capital raising. Additionally, the SEC is likely to explore further measures to limit the influence of activist investors, potentially tightening rules on short-selling and disclosure requirements for activist stake acquisitions.

Ukraine Aid

Editorial credit: Milan Sommer/ Shutterstock.

Under Trump’s leadership, the United States is anticipated to scale back the breadth or implementation of sanctions imposed on Russia while also impeding the flow of military equipment to Ukraine. Such actions may be justified as prioritizing American interests but could yield contrary outcomes. Few endeavors have bolstered America’s global influence more than its backing of Ukraine, underscoring its commitment to international stability. This support demonstrates the US’s capability to engage and mobilize resources effectively. Conversely, for nations navigating between alliances with China and the US, witnessing such a display of potent influence could influence their diplomatic calculations. Meanwhile, Vietnam has recently enhanced its diplomatic ties with the United States.

Redefine Foreign Policy

Editorial Credit: artfoto53 / Shutterstock.

Another term under Trump’s administration would likely intensify his distinctive approach. Throughout his initial tenure, Trump aligned with prominent conservative foreign-policy voices and senior military officials, often relying on their counsel. Continuing this trend might result in fewer international alliances, reduced trade engagements, and a greater emphasis on loyalists within his administration. This trajectory suggests a continuation of Trump’s characteristic style, marked by an assertive and often unconventional approach to governance.

Terrifying Prospects: 12 Moves Trump Could Unleash If Re-elected in 2024

Editorial credit: lev radin / Shutterstock.

Terrifying Prospects: 12 Moves Trump Could Unleash If Re-elected in 2024

21 Things MAGA Followers Permanently Destroyed For Everyone Else

Editorial credit: Christian David Cooksey / Shutterstock.

21 Things MAGA Followers Permanently Destroyed For Everyone Else

America’s 15 Most Miserable States Revealed: Data Shows Places You Don’t Want to Live

Image Credit: Shutterstock.

America’s 15 Most Miserable States Revealed: Data Shows Places You Don’t Want to Live

12 Ways the World Suffered from Trump’s Reckless Moves

Editorial credit:Evan El-Amin / Shutterstock.

12 Ways the World Suffered from Trump’s Reckless Moves

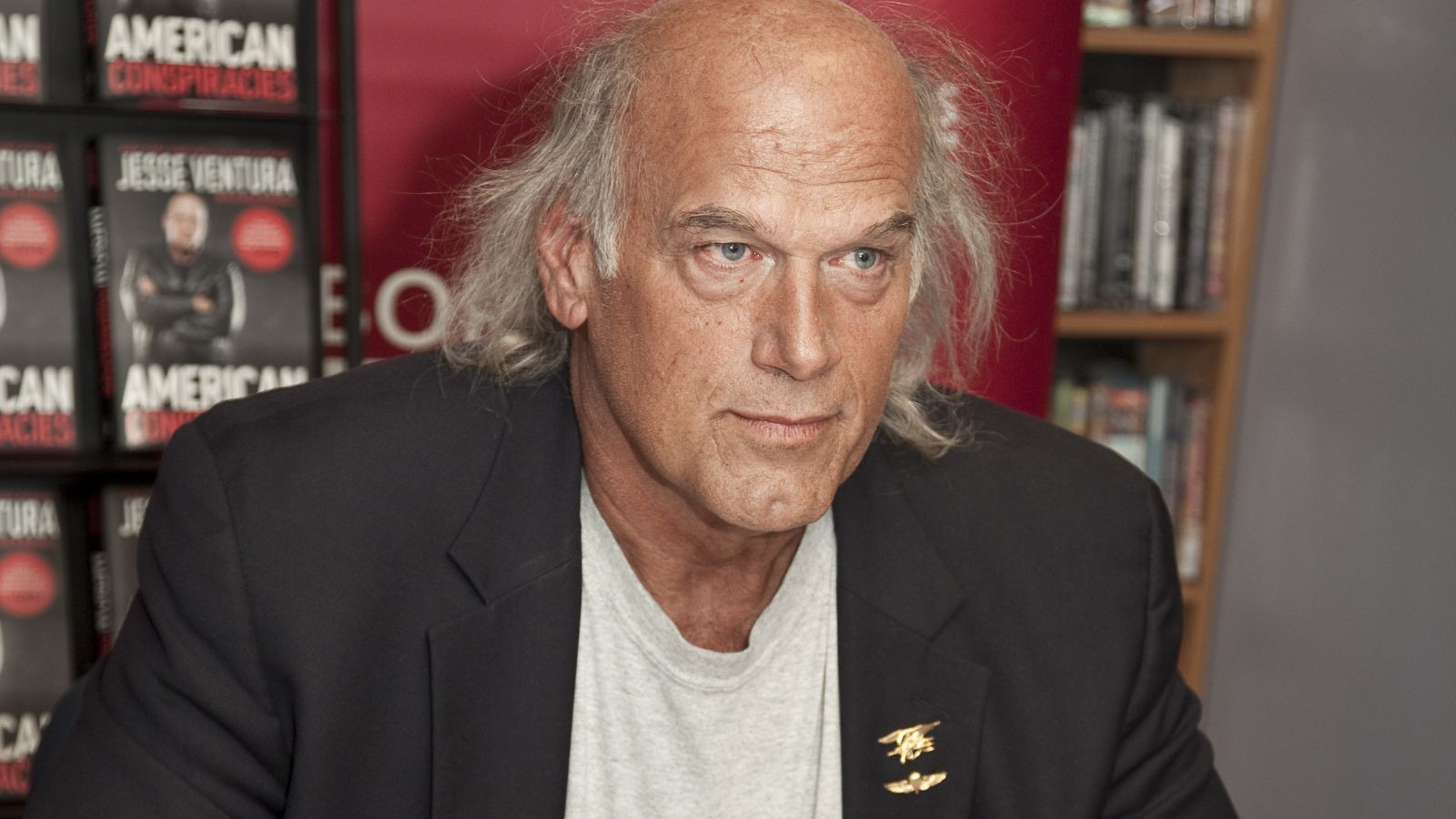

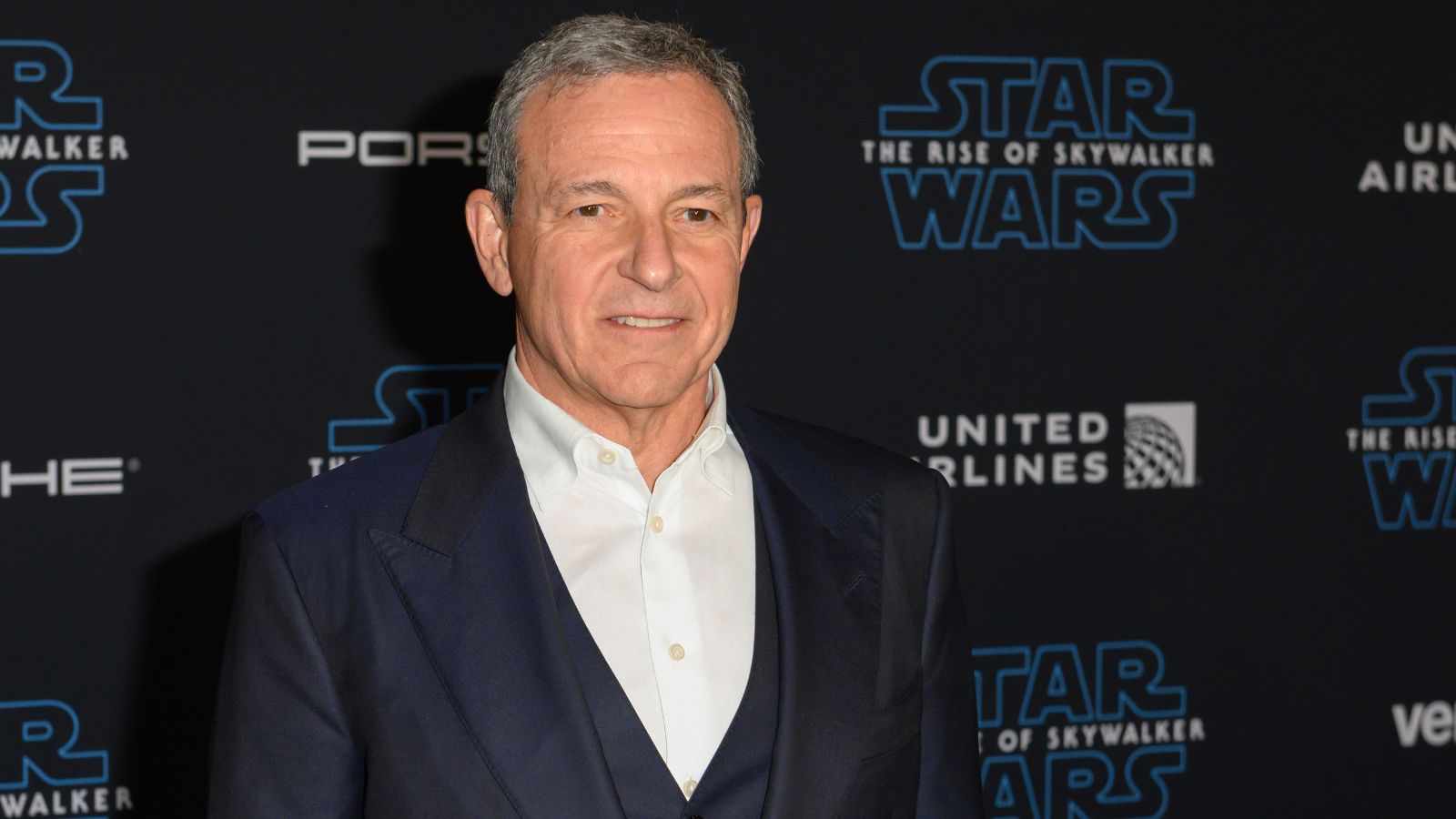

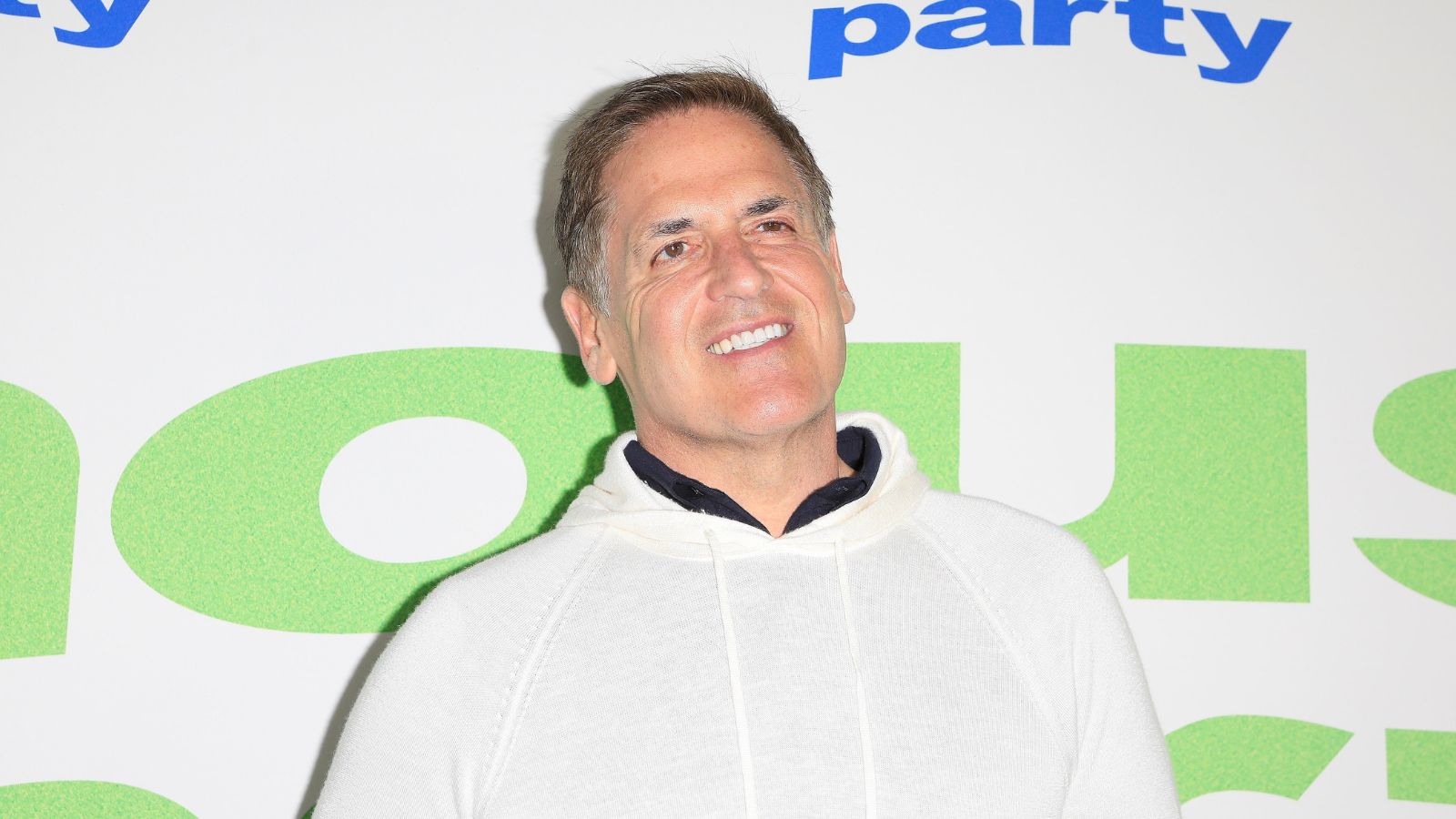

Trump’s Hit List: 18 Brands That Incited the Wrath of the Former President

Editorial credit: Joseph Sohm / Shutterstock.

Trump’s Hit List: 18 Brands That Incited the Wrath of the Former President