(Image courtesy Jeff Turner via CC BY 2.0)

A house can never be a home unless you can cover the mortgage payments. If you’re in the market, now might be the best time to buy a home. Home prices have fallen to decade lows. You may even save more money buying or bidding on foreclosed homes. But what are the risks involved with foreclosed property transactions?

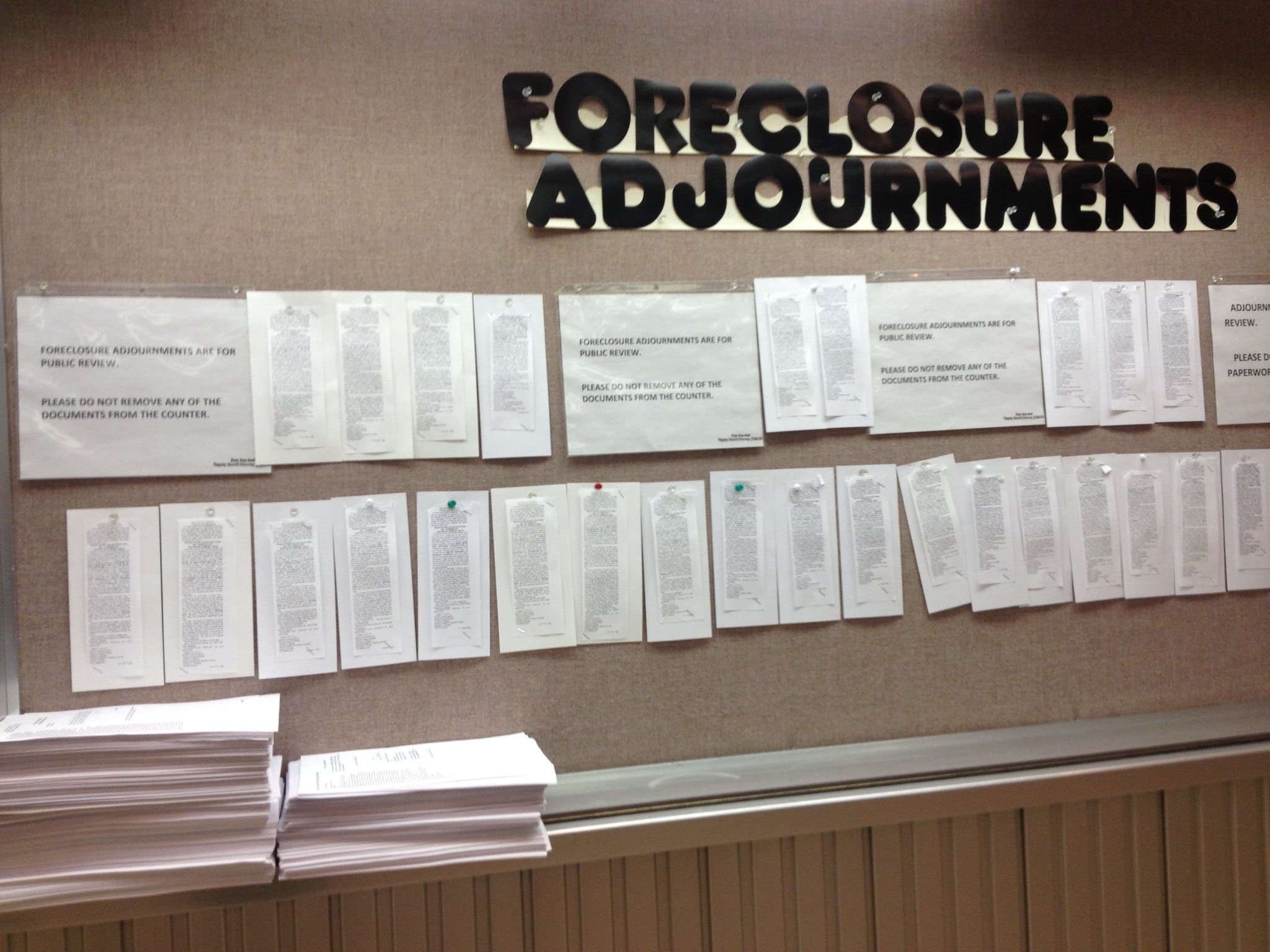

What you don’t know about foreclosure processes can be very risky to you.

Delays, interpretations of local laws, and legal bureaucracy regarding foreclosure can cause you to lose everything.

Are you already rolling your eyes at the basic legalese and bureaucratic minutiae I’m mentioning?

Please don’t.

Bidding on foreclosed properties are not a short road to home ownership for the uninformed.

It could be a long road to legal frustration and wasted money if you are not careful.

A foreclosure is the legal seizure of houses and property by a lender after a homeowner defaults on mortgage payments. The lender wants to recoup their losses via auction. Foreclosure proceedings begin after a mortgage default period of 90 days.

Foreclosure processes can last months or years – this process varies from state to state.

The general thinking is that this is a quicker road to home ownership. But the devil is in the details.

What are the risks involved with foreclosed property sales? These include:

- Paying in full after auction

- Can’t inspect property

- Hidden repair costs could negate auction savings

- Sketchy paperwork and legal drama

- Statutory redemption period

First, let’s discussed why a foreclosed property may be a more attractive option to some than buying a home outright.

The State of Home Sales and the Allure of Foreclosed Properties

In 2019, the average price of a new home was around $400,000.

As of July 2020, the average price of a new home was $330,000.

Due to the economic crisis, housing prices fell by over 21% relative to the previous year.

If the getting is that good, why try to buy a foreclosed property?

(Image courtesy Matt Hampel via CC BY 2.0 ) Long story short, a foreclosed home is a property legally seized by a bank. The bank wants to recoup the losses incurred through the previous owner’s payment issues. You can peruse foreclosures in public records. You might save 7% to 20% on the sale price of a foreclosed property at an auction sale.

Sounds good?

Not so fast. Here is a quick primer on how foreclosure auctions and sales work.

There are seeds of hints in this primer that will explain how things can go horribly wrong.

Foreclosure Auction 101

A foreclosure process unfolds in three steps:

First is the pre-foreclosure process. This is the multi-month process where the homeowner defaults on payments, the property is legally seized and then listed for auction.

The auction is the second part of the process. After the property is legally taken from the homeowner, the bank publicly auctions the property.

Third, if the property doesn’t sell at auction, the bank will sell it as a Real Estate Owned property on the open market.

You will probably get involved in the first step via perusing foreclosure listings, and secondly by visiting an auction.

OK. We got all of that out of the way.

Now, here are all the risks involved in foreclosed property sales.

The Risks Involved in Foreclosed Property Sales

You may save 7% to 20% on a foreclosure buy, but here are some headaches you might gain.

Paying a Deposit or Full Sum Immediately After Auction

After negotiating a traditional home purchase, paying for it is the last step in the process.

That is the first step in an auction.

At a sheriff or public auction, you must pay for the property on the spot. You will have to pay a significant down payment or the full price on the spot.

All auction sales are final. Also consider that you can’t inspect the property prior to bidding.

You Can’t Inspect the Property

In traditional home buying, you would be crazy not to inspect the property or have it professionally appraised.

You explicitly don’t have that option if you buy at auction.

If you buy a foreclosed property, any information you gain will be through self-initiated public record searches. You may be allowed a cursory curbside appraisal of the property, and that’s it.

You will have no idea what structural or repair problems await you after the auction.

The bank thinks you are getting a steal and won’t disclose any potential problems with you.

And talking of repair costs….

Hidden Repair Costs Could Negate Any Savings

A hidden risk involved with foreclosed property sales is the fact you may be buying a money pit.

You won’t be able to inspect the foreclosed property. The previous homeowner could have neglected their maintenance responsibilities. The foreclosure process can take months or years. By the time you bid on the property, the hidden repair costs you inherit may negate any savings you gain.

Imagine dealing with post-foreclosure sale issues like:

- Rodent infestation

- Termites

- Vandalism

- Overgrown and unkempt grass and topiary

- Electrical and water systems in need of complete upgrade

- The need for new floors or roof

You may be buying a property in need of expensive repairs.

Sketchy Paperwork and Legal Drama

When buying a foreclosed property, you’re buying it, “as is.” So, it behooves you to do some research on your own.

Conduct a title search of public records. It’s the least you can do. It could produce useful data before an auction. If someone with a valid title to the property you bought comes forward, they could legally take it from you. Yes, you could essentially pay for someone else to take your home and end up with nothing.

One of the risks involved in a foreclosed property sale are I.R.S. liens. If the property has a lien against it you’re unaware of, you aren’t absolved from inheriting the lien.

Try to hire a lawyer or realtor to go over the paperwork. If there are any mistakes, your bid could be stalled or even canceled.

Think this is bad? Want to deal with the obsessed, previous homeowner trying to get their property back?

Statutory Redemption Period (One of the Major Risks Involved in Foreclosed Property Sales)

The worst enemies you make in life are the ones you unwittingly make.

Home ownership is an identity and a life investment. Some homeowners won’t let go easily, even after eviction or foreclosure auction.

In some states, there is a process called the statutory redemption period.

The previous homeowner could have a legal 1-year grace period to regain ownership of their foreclosed home. If they pay the foreclosure price and satisfy outstanding debts, the previous homeowner could redeem their home. You lose your money and get evicted.

Make sure you don’t live in a statutory redemption state before bidding at a foreclosure auction.

Helpful Tips

Try bidding on foreclosure auctions conducted by a government agency.

Such agencies include the Department of Housing and Urban Development or the Veterans Administration. You will be allowed to inspect the property.

Get advice from someone who has bought a foreclosed property.

The most important thing to remember is to conduct your own research of public records connected to the property.

The bank isn’t going to disclose such information to you.

Buying a foreclosed property isn’t all doom and gloom.

Just don’t delude yourself into thinking it isn’t a complicated process.

Read More

HOME UPGRADES THAT DON’T ADD RESALE VALUE

STRATEGIC TAX BREAKS FOR HOME BUYERS AND HOMEOWNERS

IMPORTANT QUESTIONS TO ASK WHEN BUYING A HOME

WHAT REASONS CAN YOU WITHDRAW FROM 401K WITHOUT PENALTY?

WHAT SALARY DO YOU NEED TO LIVE IN AUSTIN?

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.