Achieving financial independence is a multi-tier process. First, you must develop a plan to achieve financial independence. And you must become completely debt-free; you can’t be both financially independent and habitually debt-ridden. You must eradicate the debt-cycle mindset – some people believe that the only way to generate income is by perpetuating debt. And you must develop an investment plan to passively generate income over time. The quickest way to get rich is to develop multiple income streams via multiple investments. You can invest in companies, stocks, water futures, tax liens, Treasury bonds or corporate junk bonds, and other investment vehicles.

Local Impact Investing: Make Money And Do Social Good At The Same Time

However, a lot of people want their dollars to matter beyond just making themselves rich. The want their investing money to serve a social good. The practice of investing for social good is called impact investing. Up until now, this has mostly been the domain of institutional money or the super rich. However, there are now several companies bringing impact investing to the local level. A noteworthy local impact investing standout is SMBX.com.

SMBX is one of the countries first crowdfunded marketplaces for small business bonds. You can invest in $10 bonds and support one or multiple small businesses on the local level through their platform. SMBX acts as an online facilitator between investors and local businesses listed on the site, making it an idea local impact investing platform.

What is SMBX? Who Is Involved? How Does It Work?

SMBX is a bond marketplace. It matches businesses who are fundraising by offering bonds with investors. SMBX was founded in 2018 by entrepreneurs Benjamin J. Lozano, Jackie Chan, Bhavish Balhotra, and Gabrielle Michelle Katsnelson.

As a bond marketplace, SMBX works with companies who need to borrow money via bond issuance. These local impact investing strategies empowers investors like you to enter the bond market on an entry-level while helping companies raise money through bond issuance.

Investors are never charged for bond investing via SMBX. Companies that want to sign on SMBX, post a profile, and initiate bond issuance fundraisers are assisted by SMBX who charge a 3.5% processing fee. SMBX screens their financials, and helps qualifying companies with paperwork, creditworthiness evaluation, and assists with marketing the bonds.

You can invest anywhere between $10 and up in each company by buying $10 bonds. With SMBX’s local impact investing strategies, small businesses can stay in business and operate on their terms.

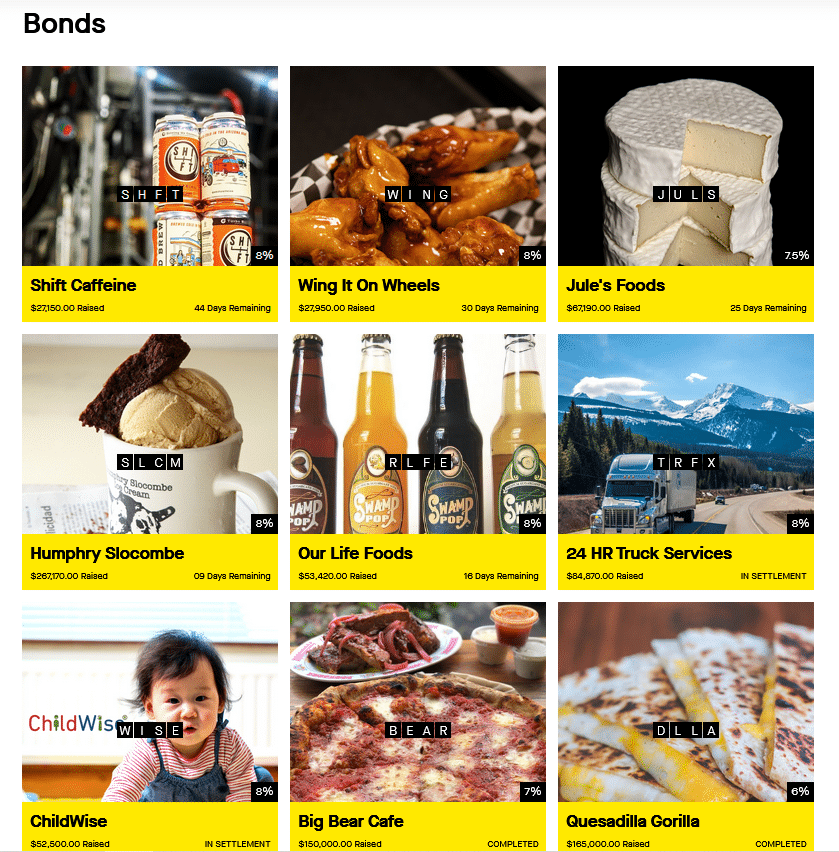

As an investor, you first register on SMBX. Next, create an account, check out the businesses profiled on the site, and then start investing via purchasing SMBX bonds. This is what your choices of companies to invest in looks like:

Easy Setup

Then, after linking a bank account or credit card to your profile, you will receive principal and interest rate payments based on your investments for 60 months. The typical SMBX bond interest payment ranges between 4% to 9%. Bond ownership is tracked by SMBX via blockchain technology. Sign up is super easy. I won’t say much more about it because a number of other bloggers have covered it (here, here, and here).

SMBX affords you easier access to bond investments. Additionally, SMBX can help novice investors ease into the process of learning about bonds.

Local impact investing via SMBX is a different way of doing business.

The easiest way to explain the services SMBX offers is to first explain the bond investment process.

What Are Bonds?

The aforementioned example is the same concept as a bond. Bonds are also known as “fixed-income investments. Financial experts in the investment world deceive novices into thinking these concepts are hard to comprehend when they are not.

92% of Americans can’t explain fixed-income investments when asked. This level of financial illiteracy is a shame because bond investments have been a dependable form of long-term income generation since 2400 B.C.

Check out this link to learn more about various kinds of bonds.

A bond is just another word for “loan.” Instead of offering a personal loan to a friend, you are offering a loan as an investor to the borrower. Usually a business or government.

Bond Rates and Terms

Bonds have a coupon rate, also known as an interest rate, that is generated on a regular basis for a predetermined period of time. The interest generating lifespan of a bond is called a maturity date, which should be printed on the bond.

At the end of the maturity date, you cash the bond and receive your principal and the accumulated interest.

For example, when you buy Treasury bonds you are loaning the American government money to conduct its operations. Treasury bonds have multiple maturity dates. As of this writing, a 30-year Treasury bond has a coupon rate of 2.23%. Interest payments are applied twice a year on treasury bonds.

Local and state bonds offer between 3%-5% interest. Corporate bonds usually offer upwards of 5% to 7%.

With SMBX’s local impact investing bonds, you can potentially earn 4% to 9% interest.

Registering on SMBX

Back to SMBX. After registering on SMBX’s site, you must link your bank account or credit card to your profile. Then you can peruse the company profiles on the site and choose one or several to invest in. The businesses listed on SMBX are seeking bond investors to launch or continue operating their businesses.

Instead of investing in the federal government or some billion-dollar corporation, SMBX empowers local impact investing which helps businesses thrive and bond investors earn a reliable ROI..

Each SMBX bond is priced at $10. So, you can buy as many bonds as the platform lets you based on your income.

You can track your investment progress anytime on your SMBX online dashboard. After the investment, your account will gain monthly payments of principal and up to 9% interest for 60 months. The money generated on your SMBX account can be withdrawn to a bank account or credit card anytime.

Pros and Cons of SMBX Offerings

One of the greatest benefits of utilizing SMBX is the ability to invest in bonds in a relatively easy fashion and learn local impact investing strategies. Local impact investing allows you to invest in bonds of local businesses that drive social change, reliably track your interest generation progress, and help a local business thrive. There are no fees charged to investors for using SMBX.

And the more businesses that SMBX aids via local impact investing bond strategies, the greater the potential for new job creation.

And businesses that fundraise on SMBX create their own brand on the grassroots level. As the businesses you invest in via SMBX grow, the more interest you generate on your investment.

And SMBX is fully regulated by FINRA and the SEC. Additionally, all bonds issued through SMBX are registered with the SEC.

SMBX Investment Drawbacks

Investing also has its drawbacks. Like any other investment vehicle, there is the potential you could lose all of your money. SMBX is a fintech start up – and is new. And while SMBX reviews the financial history of businesses in the platform, small businesses can and do go out of business.

Also, novice investors should not view SMBX as a get-rich-quick scheme. Although it’s an easier way to invest, you must exercise due diligence and conduct research.

After looking through the listings of business profiles on SMBX, you should research them thoroughly. Each business on SMBX offers a PDF version of their investment prospectuses and other vital financial information. In some cases, the bonds are secured by the assets the company owns, in some cases they are not.

You can use this SMBX interest calculator to calculate your potential return rates. Make use of it if you buy hundreds of local impact investment bonds on SMBX.

The point is do as much preparatory research on the businesses before investing. If you aren’t ready to do that, and just invest blindly in SMBX, you risk losing your capitol.

You should also find low-cost grassroots ways to promote the businesses you invest in on SMBX. After all, if the businesses you invest in struggle or don’t succeed, you don’t get a return on investment.

Local Impact Investing (Should You Invest In SMBX?)

Okay, so having waded through that, here is why SMBX makes sense if you’re interested in local impact investing.

First, SMBX puts money in the hands of the small investor, not big banks. Bond markets have historically been the playground of institutional money. However, with SMBX’s 10 dollar minimums, small investors are not able to participate. This is important because it means the model shares wealth with Joe and Jane average, not just with big banks. This means SMBX has an impact on where money flows in capitalism. That’s important.

Second, SMBX offers highly targeted investment opportunities. The businesses in SMBX are all small, local and often owned by minorities. For example, at the time of this writing, SMBX helped fund a Portland Oregon brewery, a California based Vegan cheese producer and a Washington DC cafe. All of these are local and contribute to their local economies.

So, if you’re buying these businesses bonds, you’re contributing to the growth of local economies and supporting minority owned businesses.

I encourage you to buy bonds and invest in businesses on SMBX. All bonds are registered with the SEC. You can check the progress of your interest generation at any time with your SMBX dashboard. And this method of local impact investing helps businesses operate on their own terms. If this sounds good, you can sign up => here.

Read More

How Much Do Mortgage Brokers Make Per Loan?

In A Debt Quagmire? Don’t Do This

How To Technically Get Away With Not Paying Taxes

How To Use A Credit Card For Emergencies

Image Source, William Creswell, via Flickr.

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.