If there is one thing that is certain in life, it’s the inevitability of death and taxes. You have a much better chance of escaping a horror movie villain like Freddy Krueger than you do the dreaded Taxman. How much you pay in taxes as an American citizen depends on a multitude of factors. It can vary depending on your total annual income or qualifying tax deductions and benefits. Or the inherent skill of your tax attorney or accountant in maintaining your preferred tax bracket. Check out this Free Tax Bracket Calculator.

People who make less than $10,000 a year pay nothing in taxes. Those who make $10,000 to $40,000 a year are eligible to receive refundable tax credit benefits from the government but may not escape paying taxes wholly. People who make $50,000 to $70,000 a year, about the range of the American average salary, pay about 4% in taxes. Those who make over a million dollars a year pay over 27% in taxes.

The United States collects anywhere from about $2 trillion to $4 trillion per year in taxes. However, not everyone pays their equal share, especially the wealthy. The rich, wealthy elite,and globally reaching corporations use international tax haven shelters to store and veil their true incomes. The United States loses $70 billion a year via such tactics. Almost 12% of the world’s G.D.P., almost $9 trillion, is hidden from tax collection in this manner.

So, how can the average person catch a similar break? Not easily unless you are worth millions. The closest alternative for the average American is moving to a state with no income. Many states abolish state taxes via voter referendum or as a means to entice residents of other states to relocate. There are nine states that do not tax their residents.

The No-Income Tax States

Alaska, Florida, Nevada, New Hampshire South Dakota, Tennessee, Texas, Washington, and Wyoming are all states which do not tax residents. New Hampshire does collect a tax on investment dividends and interest from income while Tennessee has a 5% tax on investment dividends and interest. There is no one-size-fits-all metric to determine how much money you may save on taxes by moving to such states. It could be a few hundred or few thousand dollars depending on your income and standard of living expenses.

No Income Tax – The Catch

No. Nothing in life is ever so easy. Just as powerful as Freddy Krueger or The Taxman is the inescapable Legislative Loophole. While technically you won’t pay any state taxes in these nine state, you are still not exempt from paying taxes against your income on the federal, city, and local level. You will still pay payroll taxes. Not to mention sales taxes. Many no-income tax states use sales taxes to compensate for the loss of state tax income.

Tennessee charges a 7% state-wide sales tax. When compounded with local city sales tax, it amounts to almost 9.5%. Washington state charges an almost $0.50 gasoline tax per gallon. Other states have vice taxes on cigarettes and alcohol. Living in a state with no income tax will not absolve you of paying property or estate taxes wither. You should heavily research what kinds of taxes you will pay in lieu of a state tax before making such a move.

Also Consider the Lifestyle Change

You should consider how drastically your lifestyle will change if you want to move to a state with no income tax. Alaska is brutally cold, remote, and physically cut off from the lower 48 states. Florida and Texas regularly deal with periods of hot weather, tropical storms, and hurricanes. South Dakota and Wyoming have beautiful, extremely remote landscapes. That means that your nearest neighbor or town could be miles away.

More Than One Reason

Moving to a no-income tax state could help you save a few hundred or thousand dollars. But it would also mean that you are invariably just trading one kind of tax for others. No one escapes the taxman. Also, depending on the state, your lifestyle could change dramatically. If you are going to make such a move, you should have more compelling personal reasons than just trying to save on state income taxes.

Read More

- 10 Great Apps For Taxes That Make Filing Easier

- What to Do if You Can’t Pay the Taxes You Owe

- How to Deduct State and Local Sales Taxes from Your Federal Income Taxes

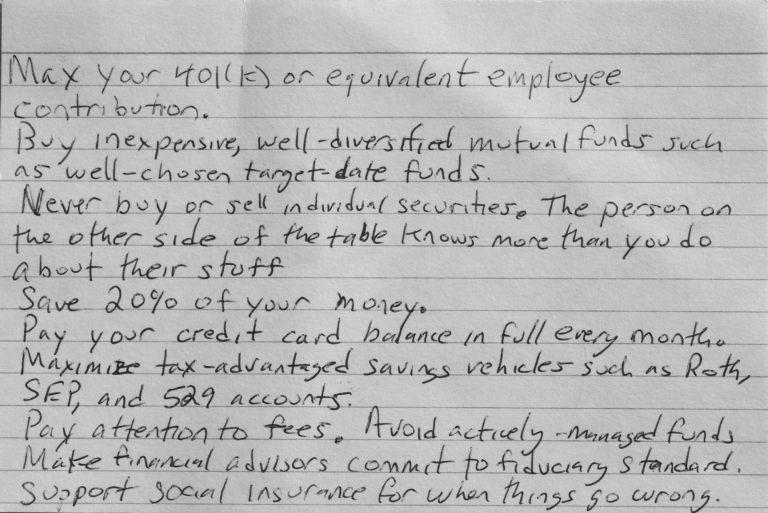

Allen Francis was an academic advisor, librarian, and college adjunct for many years with no money, no financial literacy, and no responsibility when he had money. To him, the phrase “personal finance,” contains the power that anyone has to grow their own wealth. Allen is an advocate of best personal financial practices including focusing on your needs instead of your wants, asking for help when you need it, saving and investing in your own small business.

Sometimes it seems as if there are smartphone apps for everything. There are even apps designed to help you file your income taxes each year. These apps for taxes do everything from categorizing transactions for deductions to organizing your tax returns. If you want to make filing your taxes easier this year, try out a few of these great apps for taxes.

Sometimes it seems as if there are smartphone apps for everything. There are even apps designed to help you file your income taxes each year. These apps for taxes do everything from categorizing transactions for deductions to organizing your tax returns. If you want to make filing your taxes easier this year, try out a few of these great apps for taxes.