Historically, some figures shine brightly and are idolized for their groundbreaking achievements, charismatic leadership, or revolutionary ideas. Yet, like a painting observed too closely, the more apparent details reveal imperfections and blemishes often overlooked. These 17 iconic individuals, celebrated and revered by generations, harbor tales less told—stories of darkness, cruelty, and questionable ethics. Let’s peel back the layers of time and reexamine the legacies of some of history’s most beloved figures, revealing the complicated duality of their personas.

Winston Churchill: The Brave Bulldog with Bitter Beliefs

Editorial credit: David Fowler / Shutterstock.

Winston Churchill is admired worldwide for his powerful speeches that motivated Britain during the tough times of World War II. However, his stubborn belief in racial hierarchies and decisions leading to the Bengal famine of 1943 caused millions of deaths in India. This cast a shadow over his leadership.

Coco Chanel: The Stylish Icon with Sinister Secrets

Editorial credit: spatuletail / Shutterstock.

Coco Chanel, the fashion queen who revolutionized women’s style and gave the world the iconic Chanel No. 5 perfume, had a sinister side. She used her high profile during World War II to willingly collaborate with the Nazis. Clearly, glamour and fame can sometimes cloak darker deeds.

John Wayne: The Cowboy Star with Controversial Convictions

Editorial credit: Glynsimages2013 / Shutterstock.

John Wayne is adored as a symbol of rugged masculinity in the Golden Age of Hollywood. However, he was not as heroic off-screen. His public comments showed he held prejudiced views against black and indigenous people. Despite his on-screen persona, Wayne’s real-life beliefs were in stark contrast.

Mother Teresa: The Caring Saint with Controversial Care

Editorial credit: MM_photos / Shutterstock.

Known as a selfless humanitarian, Mother Teresa dedicated her life to helping the poor in India. Yet, her mission was controversial due to criticism of poor medical practices. She also emphasized people’s pain over curing disease and allowed many people to suffer unnecessarily.

Thomas Jefferson: The Founding Father with Flawed Foundations

Editorial credit: LO Kin-hei / Shutterstock.

Thomas Jefferson, one of America’s Founding Fathers and the Declaration of Independence’s author, owned slaves. The man who wrote “all men are created equal” failed to uphold those values personally. As such, this leaves him with a troubling legacy.

John Lennon: The Musical Genius with Malevolent Actions

Editorial credit: emka74 / Shutterstock.

John Lennon was one of the legendary Beatles, and he inspired millions with his songs of peace and love. However, he openly admitted to being physically violent towards women in his past. He had a troubled relationship with his first wife and son, with both of them criticizing his behavior in later years. It’s a sad reminder that even great artists can have a hidden dark side, to them.

Alfred Hitchcock: The Master of Suspense with Menacing Conduct

Editorial credit: spatuletail / Shutterstock.

Alfred Hitchcock is renowned for his nail-biting thrillers. However, he was notorious for his abusive treatment of actresses. In particular, he sexually harassed actresses like Tippi Hedrne. Despite his clear cinematic genius, his cruel off-screen behavior damages his legacy.

Che Guevara: The Revolutionary Hero with Ruthless Reality

Editorial credit: Leonardo Panusia Ocanto / Shutterstock.

Many people idolized Che Guevara as a champion of the oppressed and as the charismatic face of the Cuban Revolution. But his revolutionary fervor didn’t extend to fair trials – he ordered numerous executions without them. He ordered the murders of numerous poets, artists, free thinkers, queer people, and those who opposed his government.

Christopher Columbus: The Discoverer with Destructive Actions

Editorial credit: Mirt Alexander / Shutterstock.

Christopher Columbus, famed for his discovery of America, holds a controversial place in history. His exploration caused mass enslavement and the genocide of native populations. The man celebrated for his exploration had a destructive impact on those he discovered.

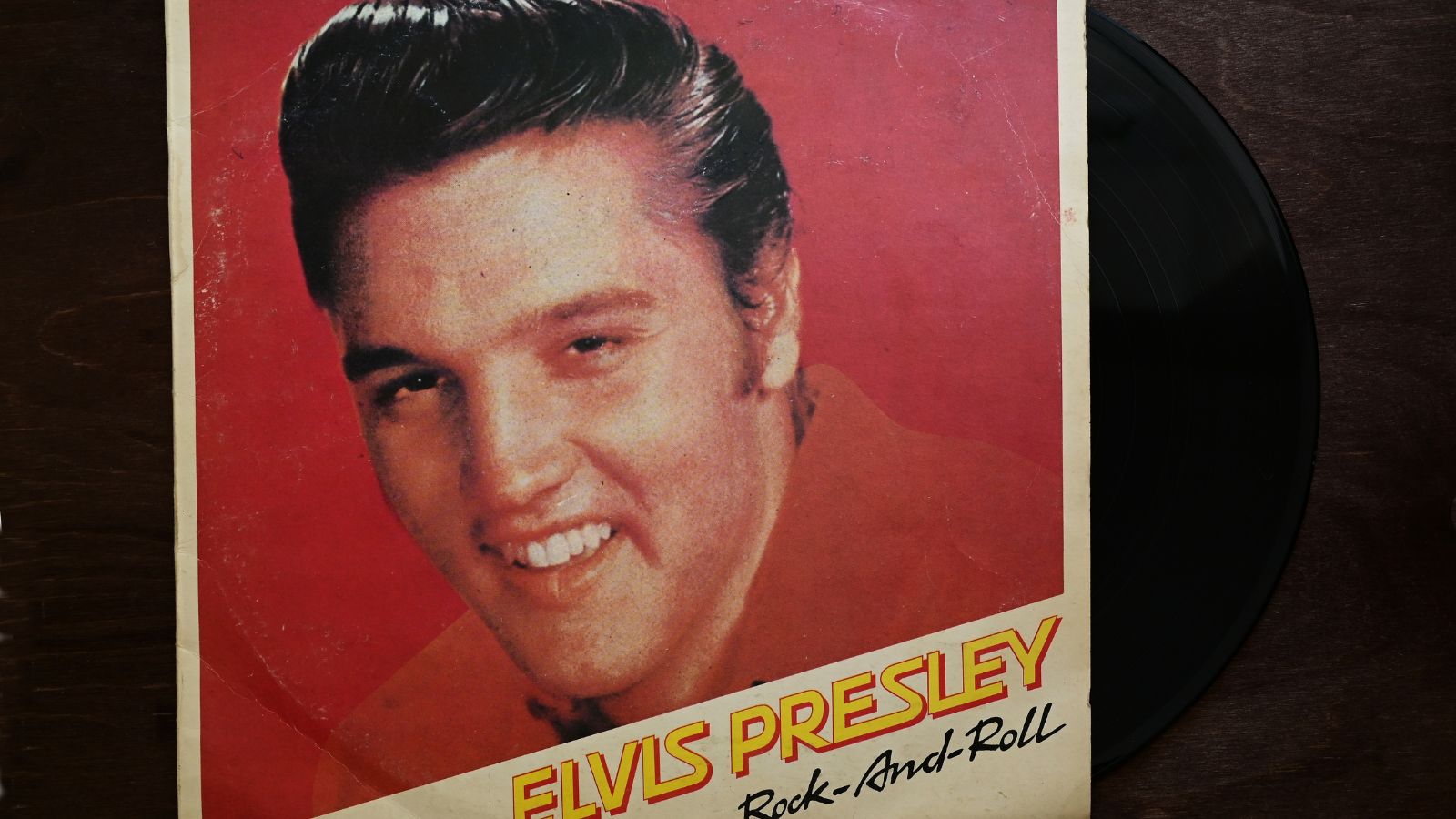

Elvis Presley: The Rock-n-Roll King with a Rotten Move

Editorial credit: Dorota Szymczyk / Shutterstock.

Elvis Presley, the King of Rock-n-Roll, is a beloved cultural icon. Yet, his personal life included a relationship with a 14-year-old when he was 24. While on tour, Presley frequently met underage girls and slept with them. After divorcing his first wife, Priscilla Presley, the rock-n-roll singer began a relationship with a 14-year-old girl.

Charles Dickens: The Storyteller with a Sad Family Tale

Editorial credit: Everett Collection / Shutterstock.

Charles Dickens is a celebrated author who many people for his empathy for the poor in his works. However, the truth is that he treated his own family poorly. He left his wife for a much younger woman, blocking his children from seeing their mother. Dickens supported Indian genocide and tried to have his wife committed to a mental asylum so he could have an affair.

Henry Ford: The Automotive Pioneer with Abhorrent Prejudices

Editorial credit: Olga Popova / Shutterstock.

Henry Ford was a pioneer who made automobiles accessible to the masses with the Model T. Unfortunately. He had a dark side. He supported anti-semitism and was part of a mutual admiration society with Adolf Hitler. He also endorsed fascism in America and spied on his workers in their homes.

Andy Warhol: The Pop Art Innovator with Plagiaristic Practices

Editorial credit: mundissima / Shutterstock.

Andy Warhol, the mind behind pop art, often took credit for others’ work. He continually overworked and underpaid his staff. While his creative contributions are clear, his habit of plagiarism darkens his reputation as an original innovator.

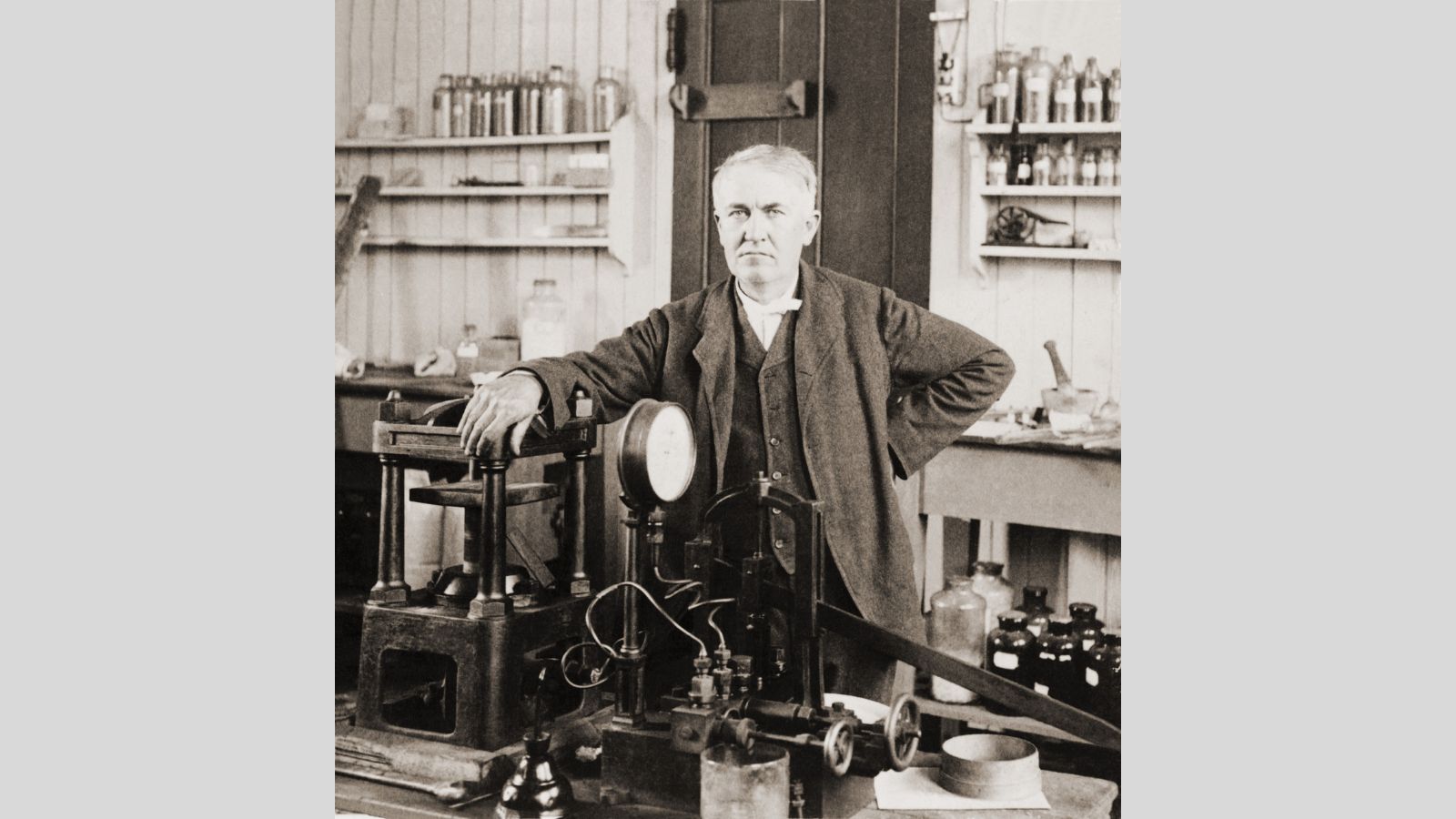

Thomas Edison: The Bright Inventor with a Dark Side

Editorial Credit: Everett Collection / Shutterstock.

Thomas Edison is known for brightening the world with his invention, the electric light bulb. However, it was not entirely his invention. He often claimed his rivals’ ideas as his own and ran a smear campaign against Nikola Tesla. He also publicly electrocuted animals to show that Tesla’s technology was unsafe.

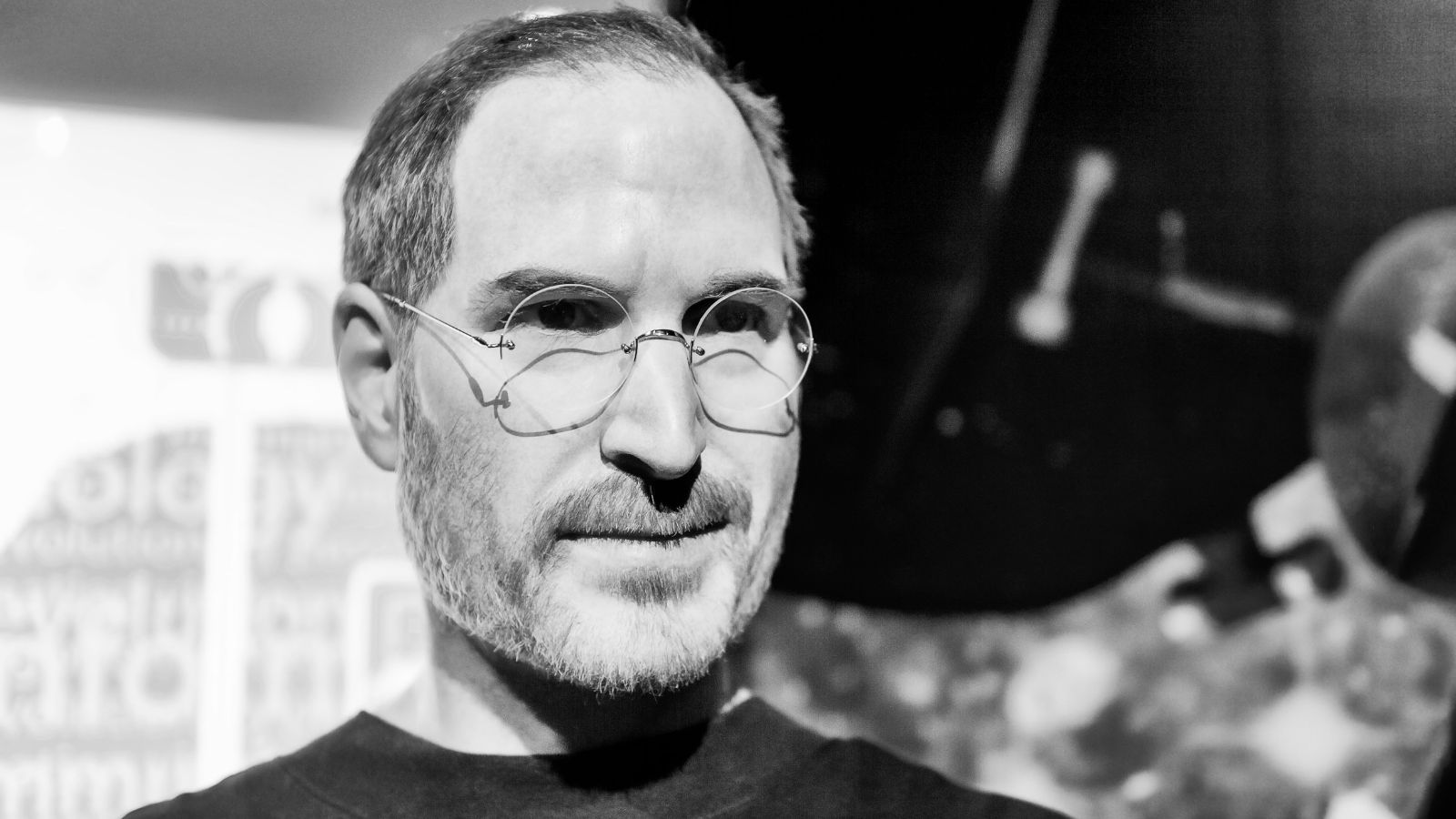

Steve Jobs: The Tech Visionary with Vexing Behavior

Editorial credit: Anton_Ivanov / Shutterstock.

Steve Jobs revolutionized personal technology with Apple. But his treatment of others, including denying fathership of his daughter and refusing to pay child support, raises questions about his character. He also spontaneously fired employees and asked them invasive questions during interviews.

Charlie Chaplin: The Silent Film Star with a Scandalous Life

Editorial credit: Sergey Goryachev / Shutterstock.

Charlie Chaplin, the silent film star known for his slapstick humor, had a scandalous personal life. He had relationships with underage girls and once tried to force his wife to get an abortion. He married a 16-year-old when he was 29 and continued to marry much younger women as he got older.

Albert Einstein: The Genius with a Grim Personal Life

Editorial credit: spatuletail / Shutterstock.

Albert Einstein, the genius behind the theory of relativity, treated his wife Mileva Maric poorly, including giving her a list of harsh conditions to live by. He helped influence the Manhattan Project, aka the development of the first nuclear bomb.

“No Boomers Allowed”: 15 States Where Retirees Are NOT Welcome

Image Credit: Rapideye via Canva.com

If you’re planning a significant change during retirement, it’s crucial to think about the kind of home you desire and the aspects you should steer clear of. “If you’re thinking about making a big move in retirement, it’s important to consider what characteristics you want in your new home and which ones to avoid at all costs,” suggests experts. To assist you, we’ve compiled a catalog of the 15 least favorable states for retirement.

“No Boomers Allowed”: 15 States Where Retirees Are NOT Welcome

16 UNACCEPTABLE THINGS BOOMERS GOT AWAY WITH IN THEIR YOUTH THAT WOULD SPARK OUTRAGE TODAY

Image Credit: DepositPhotos.

Looking back on the childhood of the boomer generation, it becomes evident that certain things once considered appropriate would never pass today’s standards. The cultural landscape has evolved significantly, leading us to recognize 16 aspects of their upbringing that would be deemed wholly unacceptable today. From unsupervised outdoor adventures to unfiltered television content, the boomer generation got away with various experiences that would undoubtedly raise eyebrows in today’s world. Let’s delve into these intriguing elements of their upbringing and reflect on how far society has come.

16 UNACCEPTABLE THINGS BOOMERS GOT AWAY WITH IN THEIR YOUTH THAT WOULD SPARK OUTRAGE TODAY

STUCK IN THE 60S: 10 THINGS BABY BOOMERS REFUSE TO LET GO OF

Image Credit: RapidEye via Canva.com

Memories of the “good old days” keep us trapped in the past. Baby boomers love to retell tales of how it was “in my day.” At the same time, millennials will tell them to get with the times. Being stuck in a time warp from which they don’t want to snap out of, here are things that baby boomers still think are fantastic. STUCK IN THE 60S: 10 THINGS BABY BOOMERS REFUSE TO LET GO OF

IT’S TIME TO LET GO: 30 OUTDATED BOOMER HOME TRENDS THAT DESPERATELY NEED TO BE SHOWN THE EXIT!

Image Credit: Shutterstock.

With the advances of social media, home trends, décor, and fads change faster than ever before. While some trends become instant classics, others can be redundant, unsensible, or just downright hideous. In a popular online forum, users shared the home fads they’re tired of seeing. We’ve compiled a list of these most disliked home décor fads, so grab a cup of coffee, and let’s look into these less-than-inspiring home design options!

IT’S TIME TO LET GO: 30 OUTDATED BOOMER HOME TRENDS THAT DESPERATELY NEED TO BE SHOWN THE EXIT!